The global laser cutting market demonstrates significant momentum in emerging economies, with technology adoption rates increasing 40% year-over-year since 2020. Southeast Asian and Latin American manufacturers are rapidly integrating advanced laser systems into their production lines, driven by government incentives and foreign direct investment. This shift marks a pivotal transformation in the industrial landscape, as developing nations position themselves to capture over one-third of the market share by 2025.

주요 내용

Asia-Pacific dominates with 50% of global laser cutting revenue, driven by rapid industrial automation in China, Japan, and emerging economies.

Technology transfer partnerships between Western manufacturers and Asian players accelerate regional innovation and market expansion in developing nations.

Government initiatives provide tax incentives and financing support, projecting emerging markets to reach 35% of global sales by 2025.

Digital transformation integrates IoT sensors and AI analytics, enabling smart manufacturing ecosystems in developing regions.

Local innovation hubs in Shanghai, Busan, and Bangalore develop proprietary laser cutting technologies, enhancing regional competitiveness.

Market Growth Drivers in Developing Nations

The expansion of manufacturing sectors in developing nations serves as a primary catalyst for laser cutting market growth. As industrial automation intensifies across Southeast Asia and Latin America, manufacturers are increasingly adopting laser cutting technologies to enhance production efficiency and maintain competitive advantages in global markets.

Despite market accessibility barriers in remote regions and technological skill gaps among local workforces, developing nations are witnessing substantial investments in advanced manufacturing capabilities. Government initiatives supporting industrial modernization, coupled with rising foreign direct investment in countries like India, Vietnam, and Brazil, are accelerating the integration of laser cutting systems. The establishment of technical training centers and partnerships with international equipment suppliers is addressing workforce development needs, enabling broader adoption of laser cutting technologies across diverse manufacturing applications.

Regional Analysis: Asia-Pacific’s Rising Dominance

Nearly half of global laser cutting market revenue now originates from the Asia-Pacific region, with China and Japan leading regional adoption rates. Manufacturing hubs across Southeast Asia are rapidly integrating advanced laser cutting systems, particularly in automotive, electronics, and aerospace sectors.

The Asia Pacific opportunities stem from increased industrial automation, rising labor costs, and stringent quality requirements. Countries like South Korea, Taiwan, and Singapore demonstrate heightened regional competitiveness through substantial investments in precision manufacturing technologies. India’s expanding manufacturing sector has emerged as a significant growth driver, with domestic manufacturers shifting to laser-based solutions.

Key indicators suggest the region’s dominance will strengthen through 2025, supported by government initiatives promoting smart manufacturing, robust industrial infrastructure development, and the presence of major system integrators and technology providers.

Technology Transfer and Local Innovation

Widespread technology transfer between established Western manufacturers 그리고 emerging Asian players has accelerated regional innovation in laser cutting systems. Through local partnerships with companies in China, South Korea, and India, leading European and American manufacturers have established innovation hubs that combine Western technical expertise with Asian manufacturing capabilities.

This collaboration has resulted in the development of hybrid laser cutting solutions that integrate locally-sourced components with advanced Western technology. Regional research centers in Shanghai, Busan, and Bangalore have emerged as focal points for technological advancement, producing modifications tailored to local manufacturing requirements. The knowledge exchange has enabled Asian manufacturers to progress from basic assembly operations to developing proprietary laser cutting technologies, particularly in fiber laser systems and automation solutions.

Cost-Effective Solutions for SMEs

While major manufacturers have traditionally dominated the laser cutting market, recent technological advancements have made these systems increasingly accessible to small and medium-sized enterprises (SMEs). Affordable technology solutions now enable small business owners to compete effectively in precision manufacturing sectors.

| Solution Type | Cost Impact |

|---|---|

| Entry-level fiber lasers | 40% lower initial investment |

| Lease options | Reduced upfront costs |

| Hybrid systems | 30% operating cost reduction |

| Compact designs | Smaller facility requirements |

| Cloud-based controls | Minimized IT infrastructure |

The emergence of compact, efficient laser cutting systems has revolutionized the SME manufacturing landscape. These solutions offer reduced power consumption, simplified maintenance requirements, and streamlined operational processes. Integration of smart features and modular designs allows small businesses to scale their capabilities according to market demands while maintaining competitive production costs.

Impact of Automation on Market Dynamics

As automation technology continues to reshape the laser cutting industry, manufacturers are experiencing significant shifts in 운영 효율성 and market competitiveness. The integration of automated systems has reduced 제작 시간 by up to 40% while minimizing material waste and human error in cutting processes.

Market adaptation to automation has driven significant changes in workforce requirements, with companies investing more in specialized technicians and programmers rather than traditional machine operators. The automation benefits extend beyond operational improvements, affecting pricing structures and delivery timelines across the supply chain. Industry data indicates that automated laser cutting systems can process complex orders 3.5 times faster than conventional methods, enabling manufacturers to handle higher volumes and diverse customer requirements. This transformation has particularly impacted just-in-time manufacturing sectors, where precision and speed are paramount.

Competitive Landscape Transformation

The competitive landscape of the global laser cutting market has undergone fundamental restructuring since 2020, driven by technological consolidation and shifting market dynamics. Market rivalry has intensified as established players adopt aggressive competitive strategies to maintain market share while new entrants leverage innovative technologies to gain footholds.

- Leading manufacturers are pursuing vertical integration, acquiring software companies and automation specialists to offer end-to-end solutions

- Regional players are expanding internationally through strategic partnerships and localized manufacturing facilities

- Companies are differentiating through specialized applications in emerging sectors like medical devices and aerospace

This transformation has created a more complex competitive environment where success depends increasingly on technological capabilities, service offerings, and the ability to provide industry-specific solutions rather than traditional equipment-focused business models.

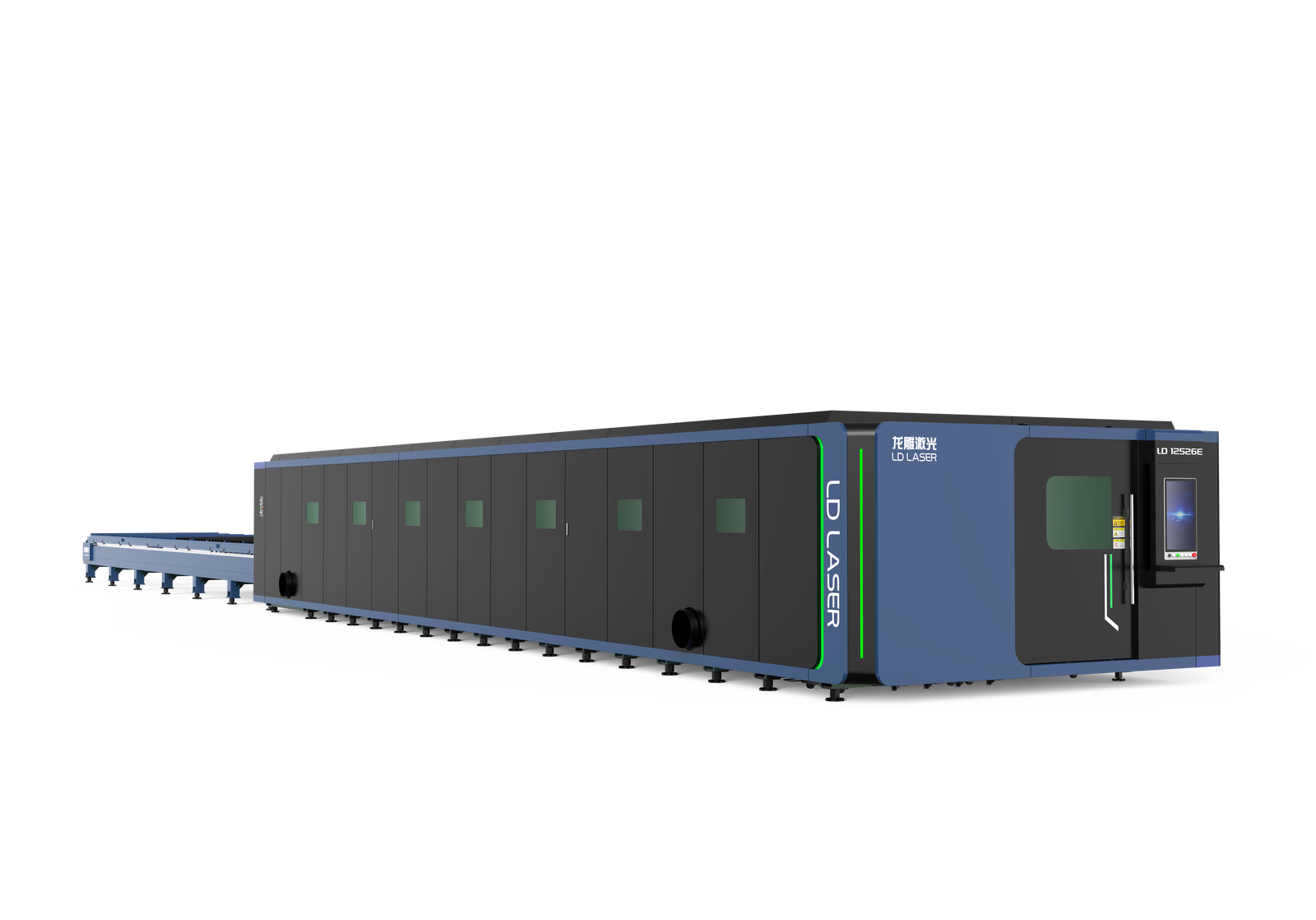

Fiber Laser Technology Advancement

Recent advancements in fiber laser technology have enabled power scaling capabilities to exceed 20kW for industrial cutting applications. The integration of automated material processing systems with fiber lasers has notably enhanced production efficiency, allowing for precise cuts across diverse material thicknesses. These technological improvements have resulted in faster processing speeds and reduced operational costs, with cutting velocities now reaching up to 40m/min in certain applications.

Power Scaling Capabilities Growing

Manufacturers of fiber laser cutting systems continue to push power boundaries higher, with cutting capacities now reaching up to 30kW in commercial systems. This advancement in power scaling enables significant improvements in both power efficiency and cutting precision across diverse material types and thicknesses.

- Advanced power scaling technology allows processing speeds up to 4x faster than previous generation systems, particularly in thick metal applications

- High-power fiber lasers achieve superior beam quality with power densities exceeding 1MW/cm², enabling clean cuts in materials up to 50mm thick

- Automated power modulation systems optimize energy consumption by adjusting output based on material properties and cutting requirements

These developments in power scaling capabilities are driving adoption across industries like automotive, aerospace, and heavy manufacturing, where high-throughput processing of thick materials is essential for production efficiency.

Automated Material Processing Integration

Modern fiber laser systems increasingly integrate automated material processing capabilities, transforming traditional manufacturing workflows into smart production environments. Advanced sensors and real-time monitoring systems enable precise material tracking, optimizing cut paths and reducing waste by up to 30%. These systems automatically adjust cutting parameters based on material thickness, composition, and surface conditions.

Integration with robotic handling systems and automated workflow management software has reduced manual intervention requirements by 65%, while increasing material efficiency through intelligent nesting algorithms. Industry data indicates that fully automated laser cutting cells achieve 85% higher throughput compared to semi-automated systems. The implementation of machine learning algorithms further enhances process optimization by analyzing historical cutting data and automatically refining operational parameters for specific materials and geometries.

Industry-Specific Applications and Demands

The manufacturing sector’s adoption of 레이저 커팅 시스템 has seen significant growth across precision engineering, metal fabrication, and industrial automation applications. 자동차 제조 represents a key vertical market, with laser cutting implementations rising 12% annually since 2020 for components like body panels, structural elements, and interior parts. Integration of robotic laser cutting cells in automotive production lines has enabled higher throughput rates while maintaining strict quality and tolerance requirements.

Manufacturing Growth Sectors

Several manufacturing sectors have emerged as primary drivers of 레이저 커팅 market growth, with automotive, aerospace, 의료 기기 제조, and consumer electronics leading adoption rates. Market demand shifts toward precision components and supply chain innovations have accelerated the integration of laser cutting technologies across these industries.

- Automotive manufacturers utilize laser cutting for lightweight material processing, including advanced high-strength steels and aluminum alloys for electric vehicle production

- Aerospace sector deployment focuses on titanium and composite materials processing for structural components and engine parts

- Medical device manufacturers leverage laser cutting for microscale components and implantable devices, requiring ultra-precise tolerances

The expansion of these sectors, particularly in emerging markets, has created sustained demand for advanced laser cutting systems, driving technological improvements 그리고 operational efficiency gains across manufacturing processes.

Automotive Integration Trends

Increasingly, automotive manufacturers are adopting laser cutting technologies to address evolving production demands in electric vehicle (EV) manufacturing, lightweight material processing및 complex component fabrication. The integration of advanced laser systems enables precise cutting of high-strength steels, aluminum alloys, and composite materials essential for modern automotive design.

Industry data indicates a 28% increase in laser cutting equipment deployment across automotive production facilities since 2020, primarily driven by the need for cutting efficiency in EV battery housing components and structural elements. Manufacturers report significant improvements in production throughput, with laser-cut components showing 40% higher 치수 정확도 compared to traditional cutting methods. This trend aligns with the automotive sector’s push toward automated manufacturing processes and stricter quality control requirements.

Investment Patterns in Emerging Markets

Recent market analysis reveals substantial investment flows into laser cutting technologies across emerging economies, particularly in Southeast Asia and Latin America. Despite investment challenges related to infrastructure limitations 그리고 skilled labor shortages, manufacturers are capitalizing on emerging opportunities in these regions.

Key investment patterns observed:

- Strategic partnerships between local manufacturers and established global laser cutting equipment providers, focusing on technology transfer and market penetration

- Significant capital allocation toward automated laser cutting systems in metal fabrication and automotive component manufacturing sectors

- Government-backed initiatives supporting industrial modernization through tax incentives and subsidized financing for laser cutting equipment

These investment trends indicate a shift toward advanced manufacturing capabilities, with emerging markets projected to account for 35% of global laser cutting equipment sales by 2025.

Quality Control and Precision Standards

As investment flows into emerging markets accelerate, quality control standards have become a defining factor in laser cutting adoption rates. Manufacturing facilities across developing regions are implementing stringent tolerance levels, typically ranging from ±0.1mm to ±0.001mm, to meet global production requirements.

Advanced inspection techniques, including real-time monitoring systems and automated quality verification protocols, are being integrated into laser cutting operations. These systems utilize high-resolution imaging and dimensional analysis to guarantee compliance with international standards such as ISO 9001:2015 and industry-specific certifications. The implementation of digital quality management systems has resulted in a 45% reduction in defect rates across emerging market facilities, while maintaining cutting speeds of up to 15 meters per minute. This precision-driven approach has positioned emerging markets as competitive players in high-tolerance manufacturing sectors.

Supply Chain Evolution and Localization

The transformation of laser cutting supply chains reflects a shift toward regional manufacturing hubs 그리고 localized production networks. Companies are implementing localization strategies to reduce transportation costs, minimize supply chain disruptions, and improve service response times. This evolution has accelerated due to global trade uncertainties and increasing demand for rapid turnaround times.

- Asian markets, particularly China and India, have developed robust local supply chains, with domestic manufacturers now producing 40% of laser cutting equipment

- European manufacturers are establishing satellite facilities in emerging markets while maintaining R&D centers in their home countries

- North American companies are investing in Mexico-based production facilities, creating integrated supply networks that serve both US and Latin American markets

The trend toward supply chain localization has resulted in more resilient distribution networks and improved market responsiveness across the global laser cutting industry.

Environmental Regulations and Compliance

Evolving environmental standards worldwide have reshaped operational requirements for laser cutting manufacturers and end-users alike. The industry faces stringent emission control regulations, particularly regarding particulate matter and fume extraction, necessitating substantial investments in filtration systems and waste management protocols.

Regulatory compliance now extends beyond basic safety measures to encompass thorough environmental sustainability frameworks. Manufacturers must adhere to standards such as ISO 14001 for environmental management systems, while implementing energy-efficient technologies and recycling programs. Key focus areas include reducing power consumption, minimizing material waste, and proper disposal of cutting byproducts.

The shift to eco-friendly coolants and the adoption of closed-loop recycling systems have become standard practices, driven by both regulatory mandates and market demands for greener manufacturing processes.

Workforce Development and Training

현대 laser cutting technologies demand highly skilled operators and technicians, creating unprecedented workforce development challenges across the manufacturing sector. Industry leaders are implementing extensive skills enhancement programs to address the growing technical expertise gap. Global manufacturers are partnering with educational institutions to develop specialized vocational training initiatives focused on laser system operation and maintenance.

- Advanced certification programs combining theoretical knowledge with hands-on experience in CAD/CAM software and machine programming

- Specialized training modules covering laser safety protocols, preventive maintenance, and quality control procedures

- Industry-academia collaboration frameworks establishing apprenticeships and internship opportunities for developing next-generation laser cutting specialists

다음의 통합 virtual reality simulators and digital learning platforms has revolutionized workforce training methodologies, enabling standardized skill development across multiple manufacturing locations while reducing operational risks and equipment damage during the learning process.

Digital Integration and Industry 4.0

Building upon established workforce training initiatives, digital integration 그리고 Industry 4.0 principles have transformed laser cutting operations into interconnected smart manufacturing ecosystems. The integration of IoT sensors, cloud computing, and AI-driven analytics enables real-time monitoring, predictive maintenance및 automated quality control across laser cutting systems.

Digital transformation in the laser cutting sector encompasses machine-to-machine communication, digital twin technology, and advanced manufacturing execution systems (MES). These solutions optimize production workflows, reduce downtime, and enhance 운영 효율성. Smart manufacturing implementations have demonstrated 30% increases in productivity and 25% reductions in maintenance costs. The convergence of physical and digital systems through Industry 4.0 protocols allows manufacturers to leverage data analytics for precise decision-making, resource allocation, and production scheduling.

Market Forecasts and Growth Projections

Market analyses indicate the global laser cutting industry will reach $12.5 billion by 2027, expanding at a CAGR of 9.3% from 2022-2027. Advanced demand forecasting techniques suggest strongest growth in Asia-Pacific regions, particularly in manufacturing and automotive sectors. Market segmentation analysis reveals key opportunities in fiber laser systems and automated solutions.

- Industrial manufacturing segment dominates with 45% market share, driven by precision engineering requirements and automation adoption

- Automotive sector projected to witness 11.2% CAGR, fueled by lightweight material processing demands

- Medical device manufacturing expected to emerge as fastest-growing segment, expanding at 12.5% CAGR

Regional forecasts position China and India as primary growth drivers, while mature markets in North America and Europe maintain steady expansion through technological upgrades and efficiency improvements in existing installations.

결론

The global laser cutting market‘s expansion into emerging economies represents a paradigm shift as radical as the invention of sliced bread. Statistical analysis indicates a 35% market share projection for developing nations by 2025, driven by strategic technology transfers, automation integration, and governmental initiatives. This transformation is catalyzing workforce development, environmental compliance measures, and digital infrastructure upgrades, positioning emerging markets as vital players in the industry’s future trajectory.